Serve the Haters

The Netflix playbook for winning “BI”

Monday morning, 9:07.

The Head of Growth drops one line in Slack:

“Which campaign drove repeat purchases this week—and what should we change today?”

A year ago, that question triggered a ritual: ticket → analyst queue → dashboard → meeting → “we’ll revisit next week.”

Now it’s a different ritual: ask → answer → action.

No dashboard. No “data request.” No waiting.

The companies happy with Tableau aren’t switching. They’ll abandon BI tools altogether. And the ones who already abandoned don’t want a new platform. They want one tool that moves one metric.

If you’re building “Tableau but with AI,” you’re already dead.

It wasn’t a switch. It’s an extinction.

The buyer is shifting from “analytics leaders” to “operators who own the metric.” And many companies skip BI entirely—they never develop the habit in the first place.

Incumbents are trapped in the old world. Here’s the playbook for building the company that replaces them.

If you only have 5 minutes: here are the key points

The traditional BI stack is dying—not because it’s broken, but because modern operators never build the habit to need it.

BI incumbents (like Tableau and Looker) rely on outdated models: dashboards, seats, and centralized teams.

The real shift: buyers are no longer analytics leads but operators who want direct answers in their workflow, not dashboards.

This mirrors the Netflix vs. Blockbuster playbook: win by serving the “haters”—the customers incumbents structurally can’t serve.

Winning products will:

Remove the “trip to BI” by delivering insights directly in tools like CRMs or ad platforms.

Replace dashboards with actions: lists, segments, triggers.

Deliver value in days, not months—no setup, no analysts.

Build compounding moats through telemetry, feedback loops, and embedded automation.

When do you even buy BI?

Think about it, for a start up growing into a series business, how many people would it take to think about buying central BI:

10 people? No.

20 people? No.

40–100 people? You won’t see it coming.

Somewhere in that range, companies used to centralize data and buy a BI stack. But if AI tools let operators answer their own questions inside their own workflows—before anyone thinks to centralize—that purchase never happens.

If you never centralize data, you never buy the central BI stack.

The category doesn’t shrink. It fails to form.

Netflix didn’t beat Blockbuster by making better stores

They won by serving a customer Blockbuster couldn’t. The Haters.

Blockbuster’s customer: people willing to drive, browse, pay per rental, and accept friction.

Netflix’s wedge: people who didn’t want the trip, didn’t want the penalty, and didn’t want the ritual.

By the time Blockbuster “adapted,” adapting meant burning down their core business model. Late fees weren’t a feature—they were 16% of revenue. They got sued over them. And they still couldn’t give them up, because the whole machine depended on that lever.

Netflix scaled the wedge with distribution centers and mail logistics—the unsexy compounding advantage.

That playbook is opening up again.

BI’s Blockbuster customer is disappearing

Tableau, Looker, ThoughtSpot—classic BI is built for analytics departments, central teams, dashboard production, governance-heavy pipelines, implementation projects measured in months.

That customer existed because functional teams couldn’t answer questions themselves.

But functional teams don’t need that mediation anymore.

Marketing asks. It gets an answer. Sales asks. It gets a list. CS asks. It gets churn risk and a next step.

They’re not “doing analytics.” They’re doing work.

Work hates queues.

The Netflix playbook: serve the customer the incumbent can’t profitably serve

Stop asking: “How do we beat Tableau?”

Start asking: “Who is Tableau structurally unable to serve?”

Here’s the playbook.

1. Find the “late fees” (the profit lever they can’t give up)

Blockbuster didn’t just have late fees. Late fees were the model. 16% of revenue. The thing they got sued over and still couldn’t stop.

BI’s late fees:

Seats (priced for teams of 15–25)

Dashboards (the artifact that justifies seats)

Everything else—implementations, governance, analyst workflows, “centers of excellence”—exists to defend those two.

Incumbents can add copilots. They can add chat. They can announce “agentic BI.”

But if they truly serve operators directly, they collapse the need for the artifact and the org that buys it.

They can’t delete dashboards without deleting what they sell.

Same reason Blockbuster couldn’t delete late fees.

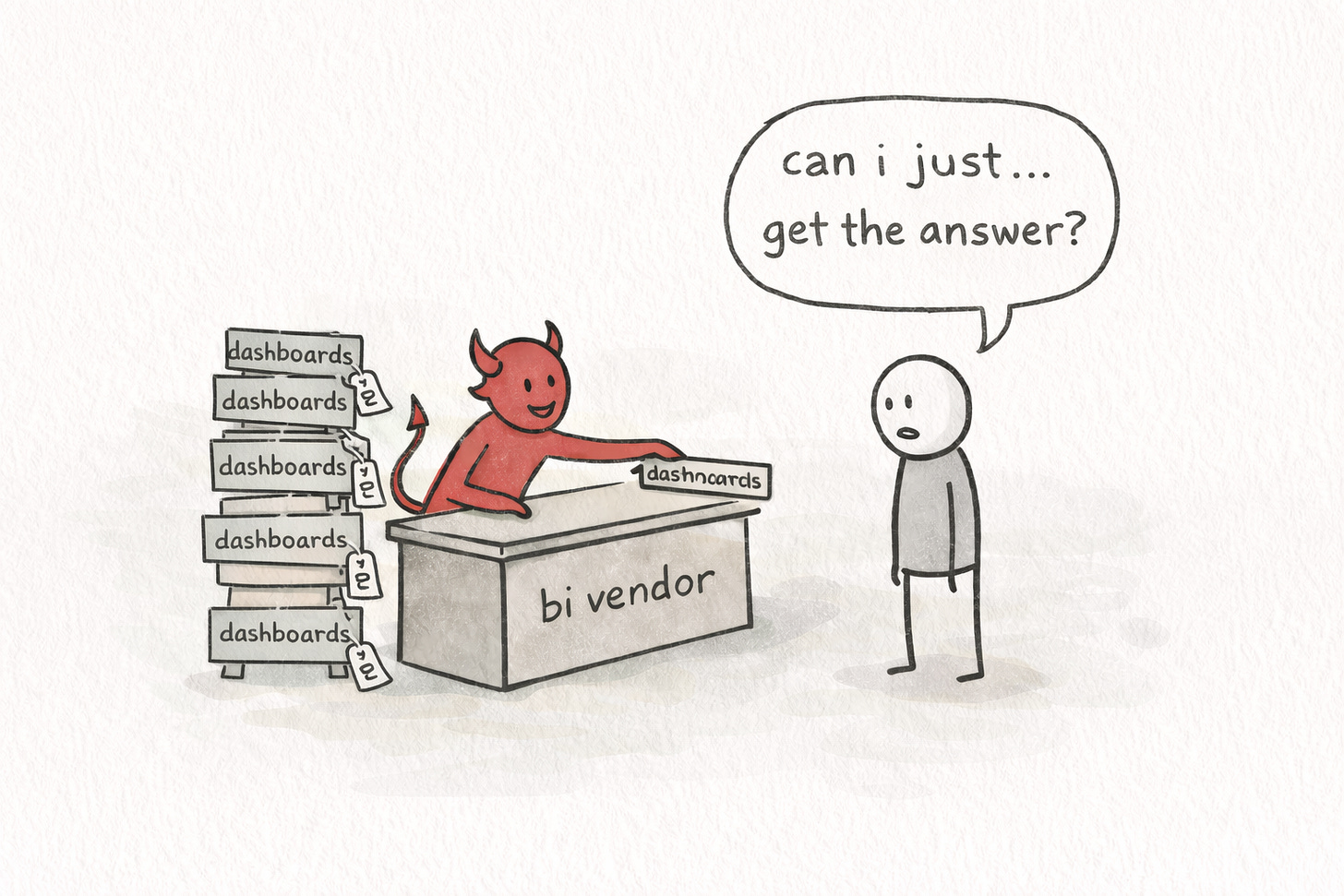

2. Pick the non-customer (the person who currently avoids BI)

Netflix didn’t target “movie lovers.” They targeted “people who don’t want the trip.”

Your non-customer isn’t “someone who wants a different dashboard.”

It’s the person who refuses BI outright:

Growth lead living in ads managers and Shopify

RevOps lead living in Salesforce and spreadsheets

CSM living in Zendesk and Gainsight

Product lead living in events, cohorts, and retention curves

They don’t want a BI tool. They want their metric to move.

The positioning that works: “No IT involvement. No data analyst required. Actionable insights in days, not months.”

That’s not “better BI.” That’s a different customer.

3. Remove the trip entirely

Blockbuster required a trip to the store.

BI requires a trip too: leave workflow → open BI → find dashboard → interpret → export → act somewhere else.

Your wedge is to remove the trip:

Answers delivered inside the workflow (CRM, support tools, ad platforms)

Outputs are lists and actions, not charts to interpret

“Show me who to call” not “show me a visualization”

Actions triggered automatically when something is true

The positioning that works: “Instead of dashboards and reports, get actionable intelligence where you already work.”

If your user has to “go to BI,” you’ve already lost.

4. Compress time-to-value until the old workflow looks like theatre

Old BI feels like: “It’s in the roadmap.”

Operator-grade systems feel like: “It’s live this week.”

Netflix didn’t just remove late fees—they removed the wait. No more “is it in stock?” No more “drive there and find out.” The DVD showed up.

The moment an operator experiences “answer + action” without a queue, the patience for “please file a ticket” dies fast.

The old world doesn’t lose on features. It loses on speed-to-outcome.

If your first value delivery takes weeks and requires an implementation project, you’re still selling to the old buyer.

5. Scale the unsexy advantage

Netflix’s compounding advantage wasn’t brand. It was operations: distribution centers, inventory flow, logistics. The stuff nobody wanted to copy because it wasn’t glamorous.

Your compounding advantage:

Operational telemetry (what users actually do, not what dashboards say)

Feedback loops (did the intervention work?)

Automation (actions that happen without humans)

Memory (what the system learns per account, per segment, per workflow)

Every time an operator acts on a recommendation, you learn whether it worked. That’s data Tableau never sees.

That’s how you get a moat that isn’t a model wrapper.

Why ThoughtSpot won’t follow—for now

All incumbents are caught in a dilemma: They see it, and they still can’t see it. Like Fish, they can’t see water. They can only swim.

ThoughtSpot sees the world moving. So they push “agentic BI”—agents that help you build, model, visualize, and distribute faster.

Here’s the problem:

That’s optimizing the existing ritual: analyst workflow → dashboard artifact → distribution.

It’s like Blockbuster launching “an AI that helps employees re-shelve tapes faster.”

Cool. But the customer is leaving the store.

They can’t delete dashboards without deleting what they sell. Same reason Blockbuster couldn’t delete late fees.

Serving operators means dashboards become optional, then irrelevant, then absent.

That’s a business model shift, not a feature release. And business model shifts are exactly what incumbents can’t do.

What to build: direct-access systems, not dashboards for analysts

If the buyer is now “operators who own the metric,” the product has to feel like this:

The system speaks the operator’s language.

Operators speak:

“Who’s about to churn?”

“Which segment is slipping?”

“What changed since last week?”

“Give me the list.”

“Fix it.”

Outputs are actions, not charts. The operator wants a list to call, a campaign to pause, a workflow to trigger, a segment to message.

The UI lives where the work lives. Embed in CRM. In support tooling. In ad platforms. In Slack with one-click action.

Default is “no setup.” Dashboards require setup, ownership, maintenance, governance. Operator systems default to: connect → ask → act.

Monday questions

If you’re building in BI-adjacent markets, answer these. No AI buzzwords allowed.

Who is the operator who refuses BI—and where do they live all day?

What artifact must die for you to win? Dashboard? Report? Ticket?

What do you deliver in 7 days with zero translators?

What action triggers automatically when the metric slips?

BI isn’t dying because charts are bad.

It’s dying because queues are unacceptable.

Netflix didn’t win by perfecting the store. They won by making the store irrelevant.

After writing this I noticed we've been implementing almost this exact framework at MAIA, so for anyone interested, there's a good implementation case study going on: https://www.linkedin.com/pulse/discard-knowledge-management-dr-sven-balnojan-4wt1f/