Eva's first 6 weeks as marketing lead at a B2B SaaS Startup

How to not get f...ed by distribution.

Repeat after me: “My start up is not Cursor, my start up is not Cursor,….. ” No, your start up is not going to grow by itself. No you’re very unlikely to have a product that simply carries you into the realm of unicorns.

It's Monday morning, and Eva is staring at her blank notebook in a small conference room at Buildr, a 10-person B2B SaaS startup that helps construction companies manage their invoices. As the newly hired "Head of Marketing"—a title that feels both exciting and terrifyingly vague—she's wondering where to even begin.

"We need more leads," the CEO had said during her interview. "We need more visibility. We need someone to run our marketing." What exactly that meant beyond the job description's laundry list of responsibilities remained unclear. “We should do g2, and get some testimonials, oh and be sure to get started generating MQLs fast! We’re way beyond schedule” the sales team told her. The second founder seems to be nervous about the “runway.” Eva is starting to feel the anxiety creep up. And it’s not yet noon!

If you only have 5 minutes: here are the key points

Focus beats everything: In early-stage B2B SaaS, trying to do everything is the enemy. Focus on one painful problem, one customer segment, one message, and one channel.

Eva’s Six-Week Plan is a repeatable marketing framework, where the sequence makes or break you:

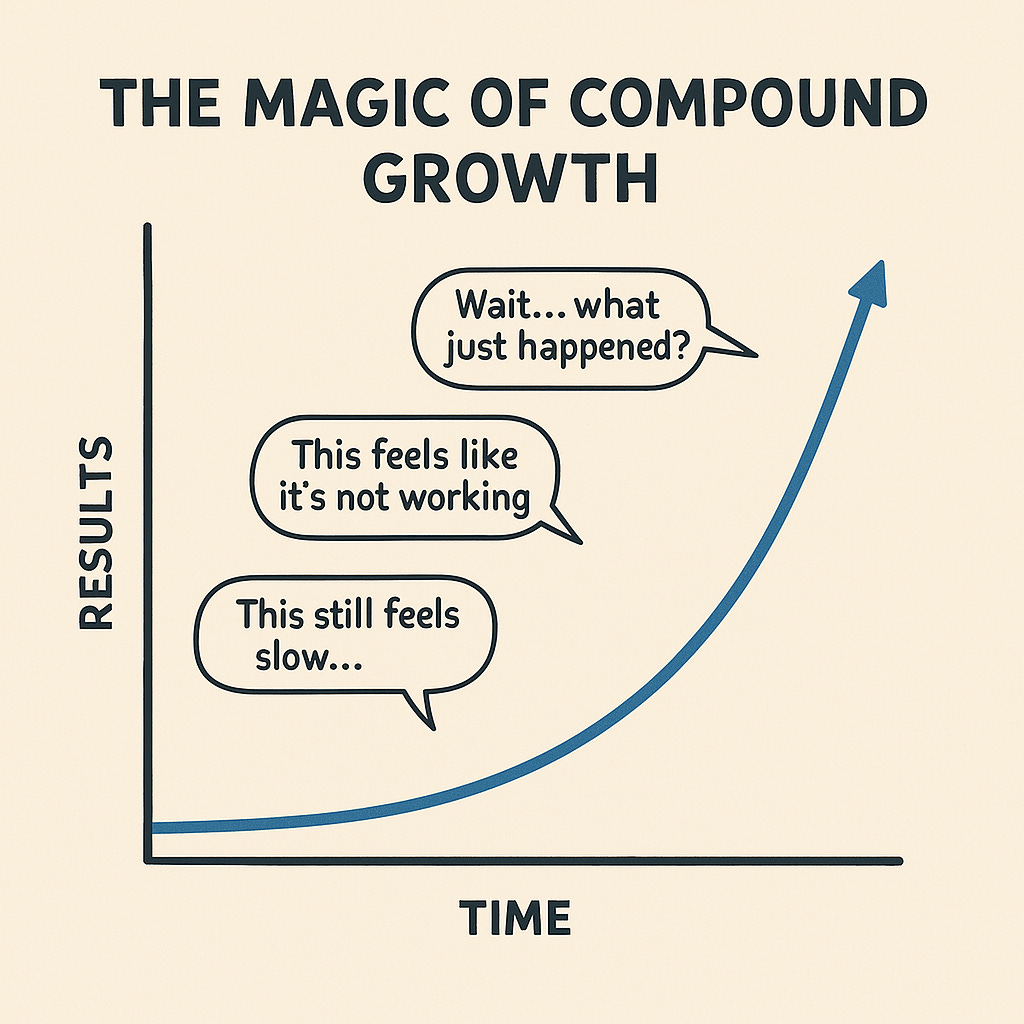

Understand your company's stage and strategic needs (Use the Technology Adoption Lifecycle for that)

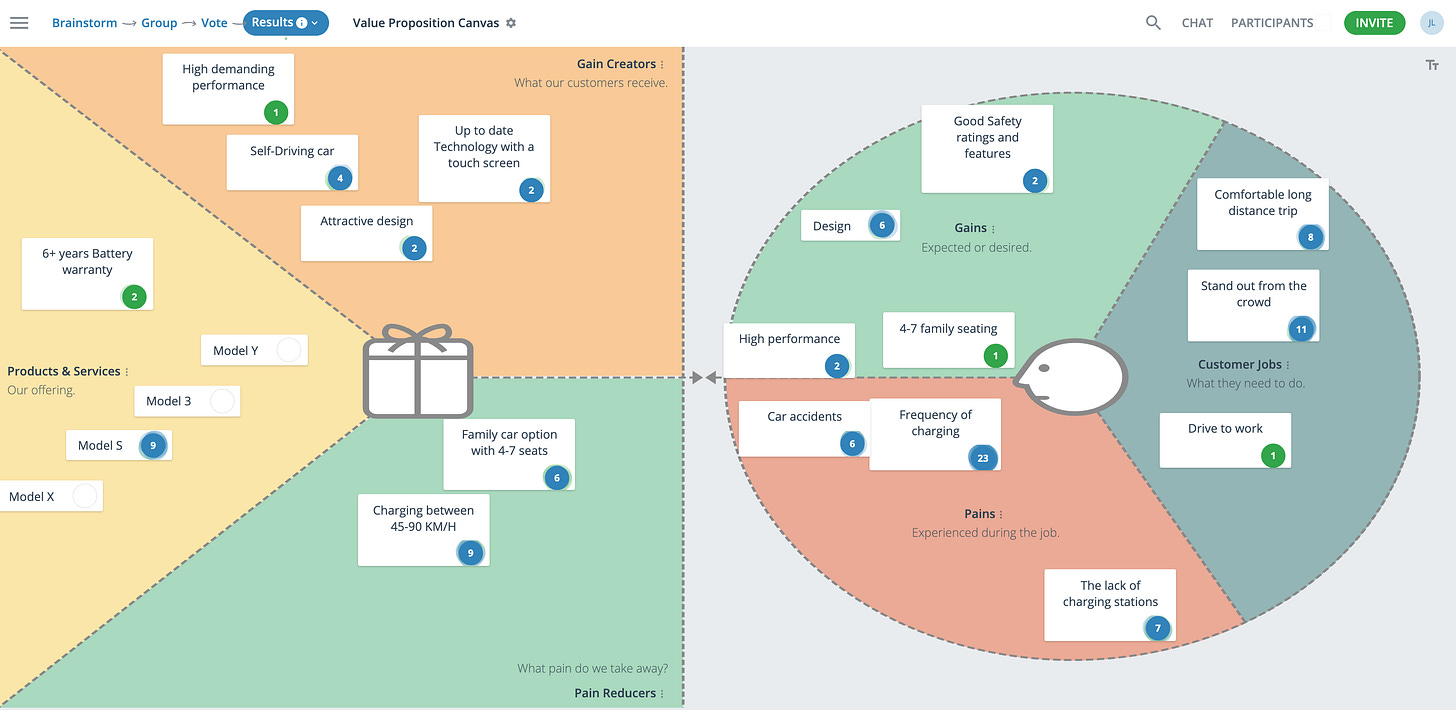

Narrow your ICP and pain point with laser focus (Use a Value Proposition Canvas)

Craft one powerful, resonant product message (Use The Product Messaging Canvas)

Test and identify your single 10x growth channel (Use the Bullseye Framework)

Double down and optimize that channel relentlessly (Crush it, with 50% more growth)

Use proven frameworks like Crossing the Chasm, Funky Flywheels, Value Proposition Canvas, and Bullseye Framework to guide your process.

Early clarity on your ICP, pain points, and messaging reduces wasted time, lowers CAC, and boosts sales velocity.

Eva is not real, but she might as well be. I felt just like Eva after our first pivot at Arch, and not so much different after our second. The challenge of bringing focus to marketing efforts in early-stage B2B companies is nearly universal. (In others probably too, but I only know B2B)

Focus in marketing is everything—yet my human brain always tries to convince me it isn't. "Oh but why don't we do this fancy new channel? Why not Linkedin Ads?" These thoughts constantly tempt me away from what actually works.

What works for me—whether developing products in companies or growing personal projects like this blog—is a simple pattern: focus, then focus, focus some more and finally focus. At Arch I’ve leaned heavily on a set of known frameworks, these helped to guide us through pivots fast, create new marketing and GTM machines from scratch and build up whole communities in our ICP blazingly fast.

So let me share, what I’d do if I were in Evas position today: here's the six-week plan I'd follow using these frameworks.

The plan, focus, focus and focus

It's strange how many startup founders excel at marketing when doing it themselves, yet treat it as an afterthought when building a systematic approach. Here's the reality: distribution breaks all but the strongest startups. Without proper marketing focus, even promising products die quietly.

If you look closely at the following steps, consider what happens when you skip one, fail to nail one, or tackle them in the wrong order. In my experience, every single misstep costs months of runway—and in startup terms, that's the difference between securing your next funding round and shutting down while competitors capture your market.

The plan is simple, the sequence is non-negotiable, and in my experience, it is incredibly hard to pull off:

Step 0: First, focus on understanding your current position. Determine how marketing fits into your company's strategy and maturity stage. If you don't get this right, you might as well start over—do nothing else until you figure this out.

Step 1: Focus on understanding the product and the customer base. Identify the one particular customer segment with a big, urgent pain that your product solves exceptionally well. Remember: value = pain (size + urgency) × solution quality.

Step 2: Focus on crafting ONE simple message for your product. Then align the entire company around using just this one message.

Step 3+: Run experiments to find your one focused channel to deliver what you've created in the steps before.

"Every day, each of us is faced with a blizzard of situations we must respond to. Without principles, we would be forced to react to all things life throws at us individually as if we were experiencing each of them for the first time. If instead, we classify these situations into types and have good principles for dealing with them, we will make better decisions more quickly and have better lives as a result." — Ray Dalio, founder of Bridgewater Capital, the world's largest hedge fund.

Step 0: Know Your Place (Day 0)

Reading recommendations: Crossing the Chasm (classic, study this one!) and Funky Flywheels (off field, but it's really good!)

Before Eva opens her laptop on day one, she needs to understand the company's true position in the market. This orientation phase is critical for everything that follows. If you get this wrong, you might as well not start. It's the foundation for a reason.

Eva starts by requesting three things from the CEO:

The complete customer list

Customer history and ACV (annual contract values)

Access to any product analytics platforms

As she reviews these materials, she's looking to answer three critical questions:

Where is the company in the technology adoption lifecycle (Crossing the Chasm!)? Looking at Buildr's customer base, Eva notices they have 20 paying customers, all of whom have slightly different use cases. Some use the product for residential construction, others for commercial projects, however she does identify 7 that seem to be particularly happy around one feature, they all have the "automatic invoicing feature" enabled. The product configurations vary for each. This tells her they're firmly in the early adopter phase. (Yes you might argue with this, it's somewhere between innovators and early adopters.)

How do you really make the distinction here? By numbers, and by looking at the reasons why people buy the product:

Innovators = one-offs who buy simply because they are innovating like crazy inside their companies. They love new tech.

Visionaries/early adopters are able to see the 10x value in your product, and buy it to simply get ahead of their market by a lot. For those, the product doesn't have to be perfect, you simply need to emphasize the 10x value.

Early majority = pragmatic people who buy the best product in the category to be up on top. They need a full and whole product.

The rest? Not relevant for Eva!

Eva sees people buying that automatic invoicing feature because as they say "it takes a huuuge pain off their lists…" A clear indicator these folks are indeed visionaries. This means, Eva can identify two tasks for her:

Help to refine the messaging to display this "10x value" and clearly identify this segment as the ICP

Start to plan the expansion from Early adopters into the Early majority by finding a beachhead segment to enter.

Ok what's next? The money!

What's the sales motion (Funky Flywheels)? Eva checks the Average Contract Value for these "automatic invoicing batch": $12,000 per year. Combined with the complexity of implementation, this suggests a marketing-led motion rather than pure marketing-led or product-led. Marketing will need to support sales rather than replace it.

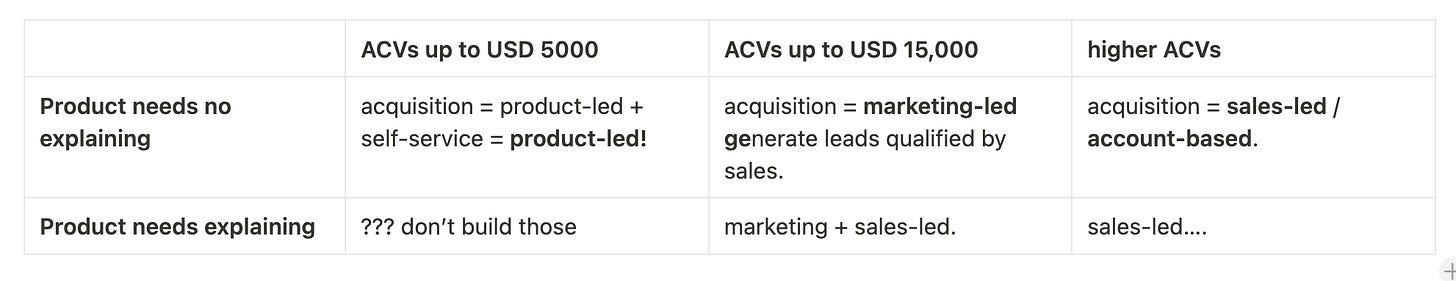

Here's a quick guide based on the Funky Flywheels book to help you determine the right sales motion for your startup:

So what does this mean for Eva? For Eva it means marketing is essential to the company success. She's about to become the bottle neck. No marketing qualified leads mean no sales, no Series A, no nothing. That's a lot of pressure!

Note: This table suggests a very different role of marketing in all cases at that point in time. If Eva is a month late in understanding her role here correctly, it means the whole time the company has to raise a Series A was just cut short by 4 weeks.

So Eva adds another to do to her list:

Start implementing a lead generation tracking framework, and start to generate marketing qualified leads as fast as possible! (Oh and coordinate with the sales team on what that actually means).

But if Eva is supposed to generate leads, with what message will she reach the audience at all?

How defined is the product-market fit (Loved)? Reviewing customer onboarding notes, Eva sees considerable customization for each client. The product manager is still defining core features based on diverse customer feedback. The onboarding docs read more like custom implementation guides than standard procedures. Even sales demos seem to highlight different features for different prospects. All these signals suggest marketing will need to help with discovery and experimentation rather than simply amplifying a proven message. So a final to do makes it onto her list:

Help the product team + the founders to define the product messaging.

That was a tough day 0 for Eva! Let's see what she's up to for the rest of week 1.

1. The Value Proposition Canvas: Finding Your Small Pond (Week 1)

Recommended reading: Value Proposition Design (And yes I do recommend you run such a workshop!)

When I join any company, this is always my first step. Before thinking about channels, content, or campaigns, I need to know exactly who we're trying to serve and what pain we're solving. And by exactly, I mean EXACTLY. I mean exactly like in I'll dig through hundreds of calls, interactions and every single piece of customer contact intel I can get my hands on. And I recommend the same to Eva.

Eva notices that Buildr has been defining their audience broadly as "construction companies that need better invoicing." Before scheduling the workshop, she spends a full day reviewing every customer conversation transcript she can find, focusing on the language customers use to describe their challenges. She also interviews the sales rep about which features generate the most excitement during demos.

On her second day, she schedules a Value Proposition Canvas workshop with the founders, lead developer, and the one sales representative. She comes prepared with specific discussion questions and printouts of key customer quotes to ground the conversation.

During the workshop, initial responses remain broad: "Our customers want to save time," or "They need better organization." Eva pushes for specificity: "Which role specifically loses the most time? What tasks are they struggling with? Show me where in these customer conversations we see evidence of this pain."

After four hours of discussion and reviewing customer interview notes, a pattern emerges. Their most enthusiastic customers are project managers at mid-sized residential construction companies who are drowning in subcontractor invoicing and struggling to meet compliance requirements.

This narrowing feels uncomfortable to the CEO. "But we can serve commercial projects too! And what about the estimators who use our platform?" The CTO adds, "We've invested in features for quantity takeoffs that don't relate to invoicing at all." Eva acknowledges these points but explains the power of focus: "We're not excluding anyone, we're just concentrating our limited resources where we can make the biggest impact right now. Once we dominate this niche, we can expand to others."

By Friday, Eva delivers a clear customer profile: "Project managers at residential construction companies with 5-20 concurrent projects who are frustrated by the time spent tracking subcontractor invoices and the risk of failing inspections."

For the first time, everyone at Buildr can describe their ideal customer in a single, specific sentence - and their pressing urgent problem.

With a clearly defined value proposition and ICP in hand, Eva is now ready to craft the messaging that will resonate with these specific customers and their urgent pain points. But creating a message that truly connects requires just as much discipline and focus as identifying the customer segment.

2. The Product Marketing Messaging Canvas: Creating Your Hook (Week 2)

Reading Recommendation: Loved (yep I know, lots of reading, but who said this is going to be easy? Easy fails)

Eva knows that jumping to tactics without clear messaging is a recipe for wasted effort. With her customer profile established, she schedules a messaging workshop to develop Buildr's core narrative.

She begins by sharing a simple framework on the whiteboard: "We help [customer] who wants to [goal/desire] by [solution approach] unlike [alternatives]." She then posts key customer quotes about compliance struggles alongside this template as reference points.

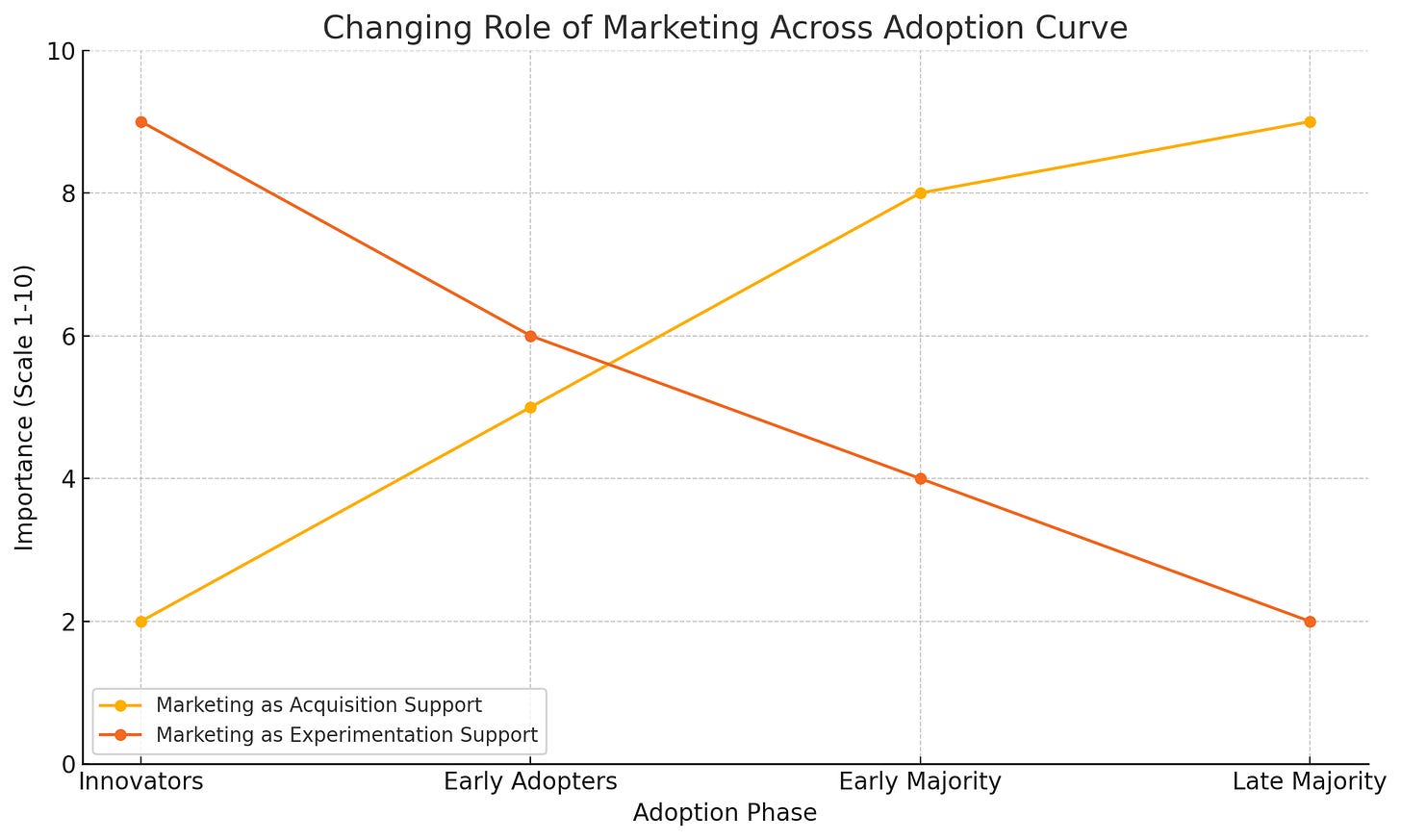

She starts by asking: "Where are we in the adoption lifecycle and what matters most to these customers?"

Since Buildr is targeting early adopters, Eva focuses the messaging on the 10x value. She has the team first individually write down what they believe is the single biggest pain they solve, then share and cluster these ideas. Next, she has them quantify the impact by collecting actual metrics from customer case studies. Finally, she guides them to refine and prioritize until they reach consensus on the core message.

The team works with Eva to craft a messaging hierarchy:

Primary message: "Buildr eliminates compliance surprises by automatically tracking and verifying subcontractor documentation in one accessible dashboard."

Supporting points:

Reduces invoicing review time by 70%

Automatically flags expired or missing credentials

Generates inspection-ready reports in three clicks

Evidence:

Case study from Baker Homes showing 15 hours saved weekly

Integration with major document providers

Mobile-first design for on-site access

Bonus Tip: When you’re actually doing it, check out Mart the CMO (a custom GPT I use to do exactly this).

The CTO pushes back: "But we also have great project timeline features! We spent three months building those." Eva acknowledges this but explains, "Right now, we need to focus on the burning pain that gets customers to sign up. We can highlight additional benefits during onboarding. Think of it as the hook that gets them in the door - once they're customers, they'll discover those other valuable features."

By the end of week two, Eva has a complete messaging framework that focuses specifically on the compliance documentation pain point. She creates a simple one-page guide and distributes it to everyone in the company to ensure consistent communication.

At the next sales call she attends, Eva notices the sales rep beginning to drift into a feature-focused presentation. She gently redirects with a question about the prospect's compliance challenges, demonstrating in real-time how to keep the conversation focused on the primary pain point. After the call, the rep admits, "When I stayed on message, I could see them leaning in more."

With a clear value proposition and focused messaging established, Eva now faces her next challenge: determining the most effective channel to deliver this message to their target customers. Two weeks have already passed - for a startup with a limited runway of maybe 1-2 years between funding rounds, this represents about 5% of their available time already gone. The pressure to generate qualified leads is mounting.

3. The Bullseye Framework: Identifying Your 10x Channel (Week 3)

Recommended reading: Traction

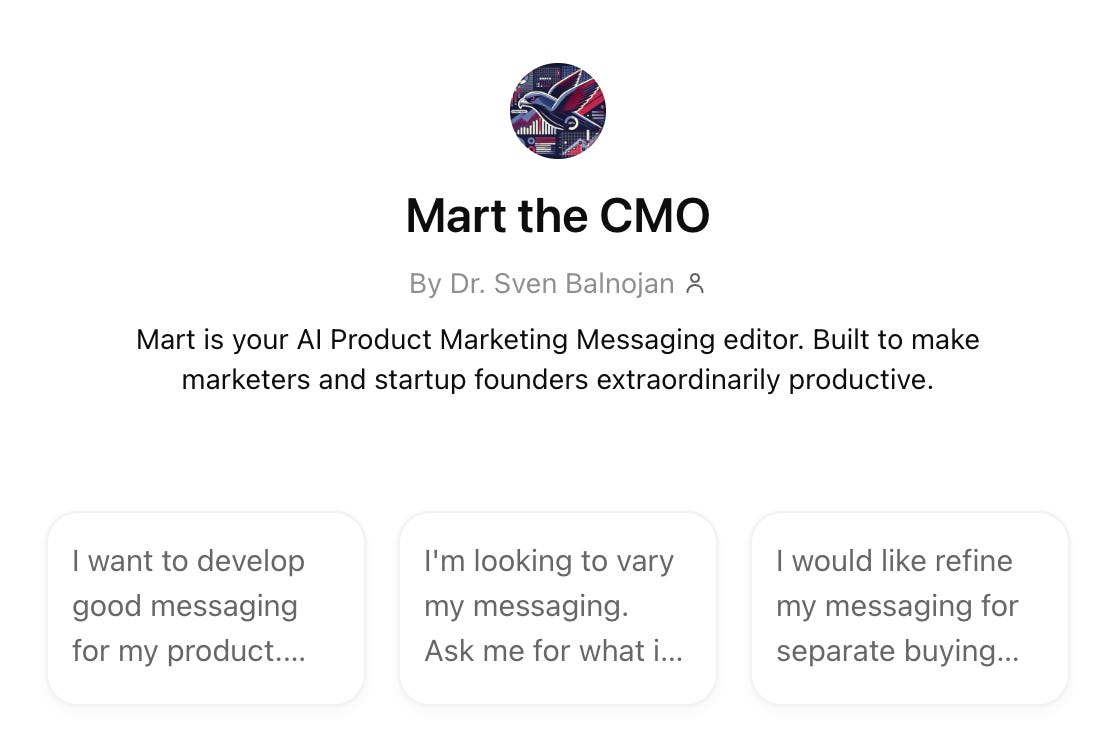

Eva knows that with limited resources (basically only herself + whoever she can motivate to help her create content like gated content pieces, blog posts,…), she needs to find the one marketing channel that will outperform all others. Why? Because it exists. And since the focus is on marketing-led lead generation, if she finds two channels, one generating 10 leads a week, and another 20, she knows if she spends 100% of her resources on channel 2, she will generate 40, and thus increase the lead generation rate by 35% compared to splitting resources between both channels.

Focus isn't just a nice-to-have - that 35% weekly improvement is the difference between winning and losing. In startup terms, it could mean reaching profitability a full quarter earlier or hitting the lead targets needed for the next funding round.

Luckily, Eva has just read Traction and knows about the Bullseye Framework.

The bullseye framework is super simple.

In Step 1, Eva writes down a long list of potential channels relevant to the ICP of construction companies:

Industry conferences

LinkedIn advertising

Construction trade publications

Construction-focused podcasts

Local builder associations

Partner co-marketing (with software they already use)

SEO for compliance-related keywords

Content marketing focused on regulatory changes

Webinars on documentation best practices

Direct outreach to residential construction companies

YouTube tutorials

Facebook groups for construction professionals

Bonus Tip: Read up Andrew Chen’s take on the current situation of marketing channels. Seriously, do that, don’t waste your time on channels people know won’t work for you.

She pulls out numbers and estimates for all of those channels. For example, she notes that construction trade publications have a CPM of $35-50 and readership demographics that skew toward executives rather than project managers. For local builder associations, she discovers there are 32 chapters in their target regions with average attendance of 40-60 project managers per monthly meeting.

Step 2: Eva ranks each channel based on audience fit, cost, speed to results, and team expertise. While industry conferences might eventually offer strong leads, the upcoming conference is still three months away - too long to wait given their runway constraints. LinkedIn advertising targets the right people but at a high acquisition cost estimated at $300-400 per lead. She selects the top three for testing:

Local builder association partnerships

Content marketing focused on compliance best practices

LinkedIn advertising targeting project managers

For each channel, she designs a specific experiment with clear metrics:

For local associations: Offer a free educational workshop, measure attendees and meeting requests

For content: Create three articles about avoiding compliance pitfalls, measure downloads and demo requests

For LinkedIn: Run targeted ads with compliance messaging, measure click-through and form completions

Eva presents this plan to the CEO with specific success criteria for each channel. The CEO questions whether focusing on local associations will scale fast enough: "Can we really reach enough project managers through these local meetings?" Eva comes prepared with calculations: "There are 32 chapters in our target regions, with approximately 50 project managers per chapter. If we can convert just 10% of those to demos, that's 160 qualified leads - more than we've generated in the last six months combined. And we can test this approach in just two weeks."

"After two weeks of testing each," she concludes, "we'll know which one deserves the bulk of our resources. Then we'll enter into optimization."

4. Channel Experimentation & Selection: Becoming the Big Fish (Weeks 4-6)

Over the next three weeks, Eva methodically executes her channel experiments.

The local builder association test produces surprising results. After presenting at just one chapter meeting, they receive five demo requests—more than they typically get in a month. Attendees specifically mention the compliance pain points Eva highlighted in her talk.

Seeing this early success, Eva doesn't wait to optimize. She immediately refines her approach for the next association meeting: shortening the presentation to allow more Q&A time, adding a live demonstration focused specifically on the compliance dashboard, and creating a one-page handout that highlights their core message. She also develops a simple follow-up sequence for attendees who don't immediately request demos.

The content marketing shows moderate success. Their article on "The 5 Most Common Documentation Mistakes That Fail Inspections" generates steady traffic and four lead form submissions over two weeks.

The LinkedIn campaign underperforms significantly. Despite careful targeting, the cost per click is high and none of the clicks convert to demo requests.

Eva doesn't wait for the full testing period before adjusting. She redirects some of the LinkedIn budget to secure speaking slots at three more builder association chapters.

By the end of week six, the pattern is clear: local builder associations represent Buildr's "10x channel." Eva prepares a comprehensive go-to-market plan that focuses 70% of their marketing resources on this channel:

Developing a standardized workshop that any team member can deliver

Creating supporting materials specifically for association events

Building relationships with chapter leaders across their target regions

Using content marketing as a supporting channel to establish credibility

When she presents this plan to the leadership team, the CEO is initially skeptical. "Just association meetings? Shouldn't we be doing more?"

Eva shows him the data: "The acquisition cost through associations is $50 per lead compared to $350 through other channels, and the close rate is 25% versus 12% for our website leads. This is our small pond. We'll dominate here first, establishing Buildr as the go-to solution for compliance management among residential project managers. Once we've captured this market, we'll have the revenue and case studies to expand into adjacent segments like commercial construction—but from a position of strength rather than spreading ourselves too thin."

The Result: From Scattered to Focused

Three months later, Eva has delivered more qualified leads than Buildr received in the entire previous year. By focusing intensely on a specific customer (residential construction project managers), a specific pain point (compliance documentation), and a specific channel (builder associations), she's created a repeatable, efficient marketing engine. The metrics tell the story: before Eva's focused approach, Buildr's lead-to-demo conversion rate was 8%, with a demo-to-customer rate of 15%. Now, leads coming through the association channel convert to demos at 32%, and 28% of those demos become customers. The overall customer acquisition cost has dropped by 60%, and the sales cycle has shortened from 62 days to 41. What made the difference wasn't revolutionary tactics—it was the disciplined application of these frameworks in the right sequence, combined with the courage to maintain focus despite the constant temptation to broaden efforts. Where the old Eva might have felt overwhelmed by the endless possibilities and pressure to "do it all," the focused approach has brought both better results and greater clarity. The anxiety of those first days has been replaced by the confidence that comes from a clear, proven strategy. Eva found her small pond and became the dominant fish. As Buildr grows, they'll gradually expand to larger waters—but only after mastering their initial territory. This focused approach is counter to our natural instincts. We want to cast wide nets, explore all channels, and speak to everyone who might possibly buy our product. But particularly in B2B environments with limited resources, the path to growth isn't through breadth—it's through depth.